上市公司现金流量质量分析-以岳阳纸业为例

来源:56doc.com 资料编号:5D6466 资料等级:★★★★★ %E8%B5%84%E6%96%99%E7%BC%96%E5%8F%B7%EF%BC%9A5D6466

资料以网页介绍的为准,下载后不会有水印.资料仅供学习参考之用. 密 保 惠 帮助

资料介绍

上市公司现金流量质量分析-以岳阳纸业为例(含选题审批表,任务书,开题报告,毕业论文16000字)

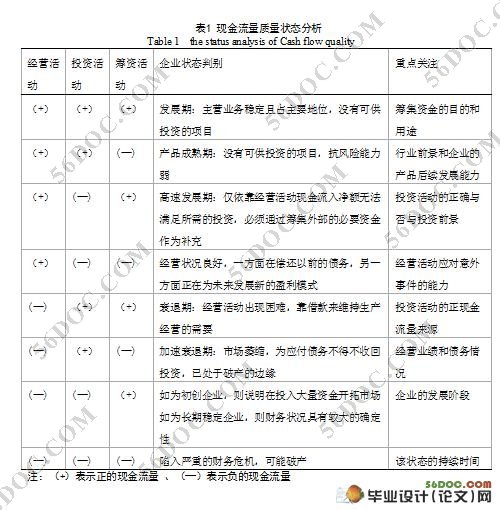

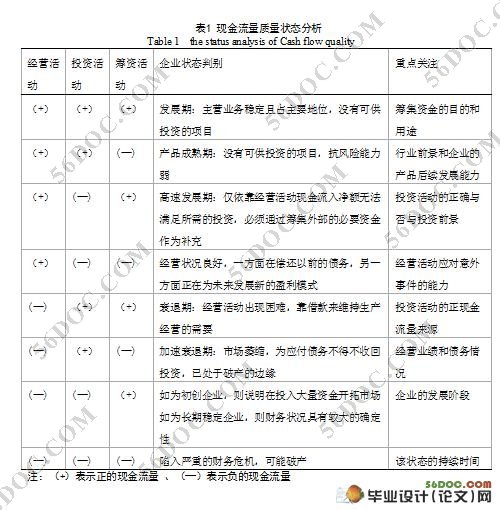

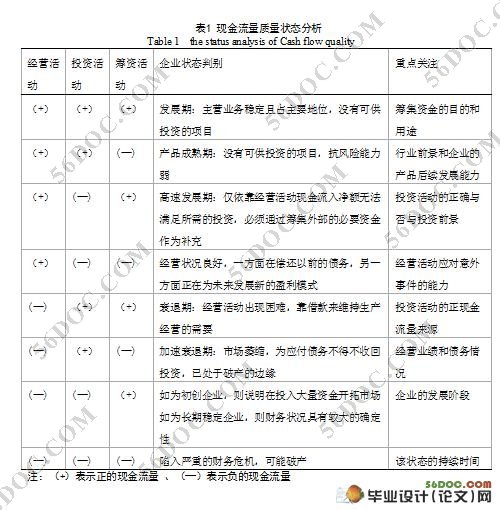

摘 要:根据上市公司的经营特点和财务特征,以上市公司的现金流量质量为研究对象,对经营活动现金流量做出质量判断。然后运用现金流量的结构分析,企业偿债能力分析,获利能力分析,以及企业发展能力分析等方法来阐述如何运用现金流量来判断企业的财务状况以引导公司经营者做出正确的决策,提升公司业绩,同时为投资者提供一定的依据。最后,结合实例岳阳纸业股份有限公司,指出上市公司如何制定现金流量策略和建议。

关键词:上市公司;现金流量;岳阳纸业

Analysis on Cash Flow Quality of Listed Companies —Take Yueyang Paper Group as A Case

Abstract:According to be listed's management characteristic and the financial characteristic, after take To be listed's compensation non-outlay coat's management cash flow as the object of study, makes the quality judgment to the operative activity cash flow. Then knew using cash flow's structure, the enterprise credit capacity analysis, the profit ability analysis, as well as methods and so on enterprise development ability analysis elaborated how to analyze enterprise's financial situation using the cash flow to guide the company operators to make the correct decision-making, the promotion company performance, simultaneously provides certain basis for the investor. Finally, unifies the example Yoyang paper industry Limited liability company, pointed out how to be listed does formulate the cash flow strategy and the suggestion.

Key words:Listed company;Cash flow;Yueyang Paper Group

|